Wait, how many days do I have to go into the office? As many as it takes

This week, the largest publicly traded company in Canada by market capitalization — the Royal Bank of Canada — told its employees to return to the office at least four days a week starting this fall (you know, once the summer is over). This is a first among Canada's largest banks, but it's still more timid than what US banks have been doing. JPMorgan Chase, for instance, asked its employees at the start of this year to return to the office 5 days a week. Goldman Sachs did the same way back in March 2022. And when people weren't doing it, they sent reminders.

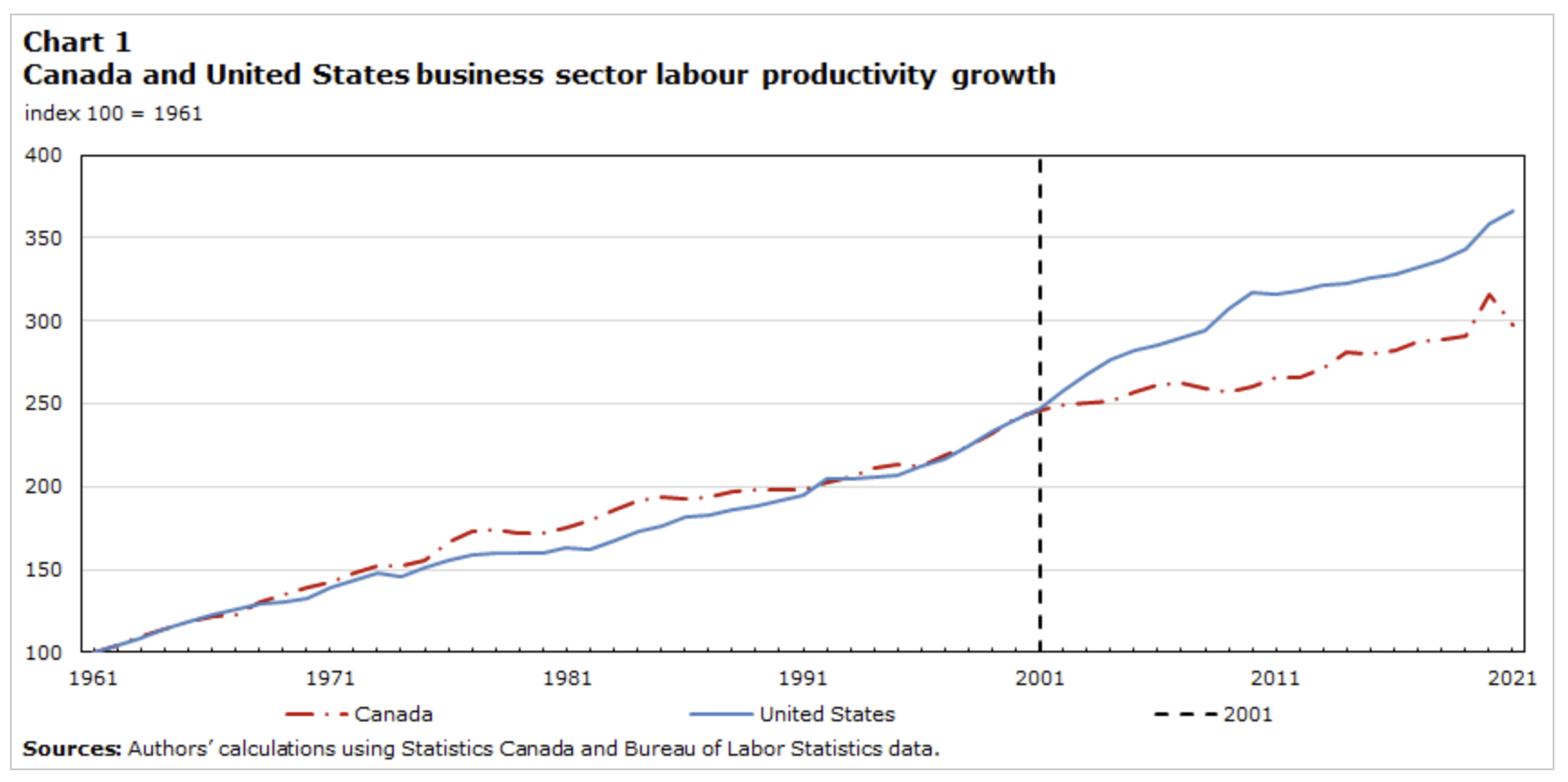

Since at least 2023, RBC has been saying that remote work is hurting productivity. And if that is true, then this is an imperative. Of course, it's also a positive thing for cities. In-office work is a centralizing force. But the really important thing to be focused on here is productivity. Canada has an existential productivity crisis. We used to closely track the US, until we didn't. From 2001 to 2021, the US saw its labor productivity grow at roughly 2% per year. In Canada, our growth rate fell to 0.9% per year, which is why this chart from Statistics Canada looks the way it does.

What this suggests is that the Canadian economy has not yet entered the 21st century. We haven't innovated enough. We aren't commercializing enough of our research. We aren't taking enough risks and funding new ideas. We aren't starting enough big new companies (despite being smart and highly educated). And I would argue that we over-indexed on housing and construction. And I say this last point as a real estate developer! Though it's not as self-sabotaging as it may seem. Developers need a strong macro environment in which to build into. You can't grow a robust economy by just building housing.

Now, I don't know if any of these things will absolutely require people to be in an office 5 days a week. Maybe hybrid is enough. Productivity isn't perfectly correlated with in-office work from what I can tell. But I do know that for Canada to enter the 21st century it's going to require hard work, a culture of greater risk taking, more innovation and entrepreneurship, and a relentless desire to out-compete the rest of the world. The goal is to be the best, or at least it damn well should be. But for this to happen, I do believe that, broadly speaking, it will demand more, not less, time together with people.

Cover photo by Annie Spratt on Unsplash

Not grand retail

The Frank Gehry-designed Grand LA is a prominent mixed-use development in downtown Los Angeles that sits across from the celebrated Walt Disney Concert Hall (which was also designed by Gehry). Developed by Related, the project occupies an entire city block and contains a 305-room hotel by Hilton, 347 luxury rental apartments, 89 affordable apartments, and over 164,000 sf of retail space.

According to Bloomberg, most of the project is doing quite well. The hotel occupancy rate is at 69%, the hotel restaurant is busy, and the residential is more than 95% leased. The problem is the retail.

Since the project opened in 2022, most of it has gone unleased. Though two new anchors were just announced: an AI museum called Dataland and a permanent home for the University of Michigan's Ross School of Business, which runs an executive MBA program in LA.

But these aren't traditional retail tenants. And it's almost certainly not what was being modeled when the project broke ground in 2019. Back then, everyone was still going into the nearby offices. And those humans would have brought foot traffic. This is one of the tricky things about development — you end up building through different macro environments.

But even in the best of times, it's generally hard to say with exact precision what will be successful. That's development. If there's comparable product, then you can comp against that (less risk). But if there isn't (more risk), you're faced with the question: Does comparable product not exist because there's no market for it, or does it not exist simply because nobody has done it yet?

If you're developing, it's because you believe the latter.

18 rue Pradier

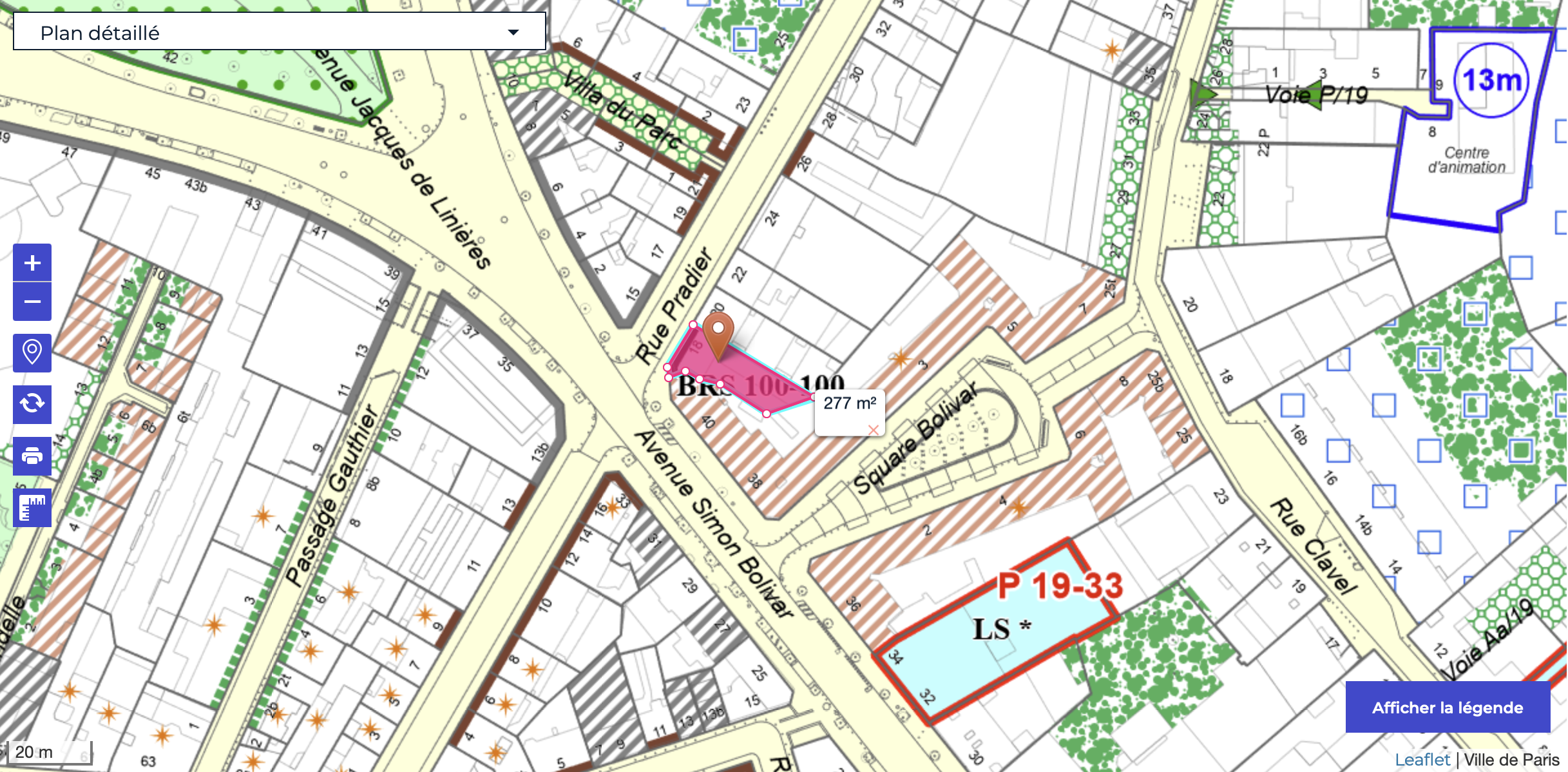

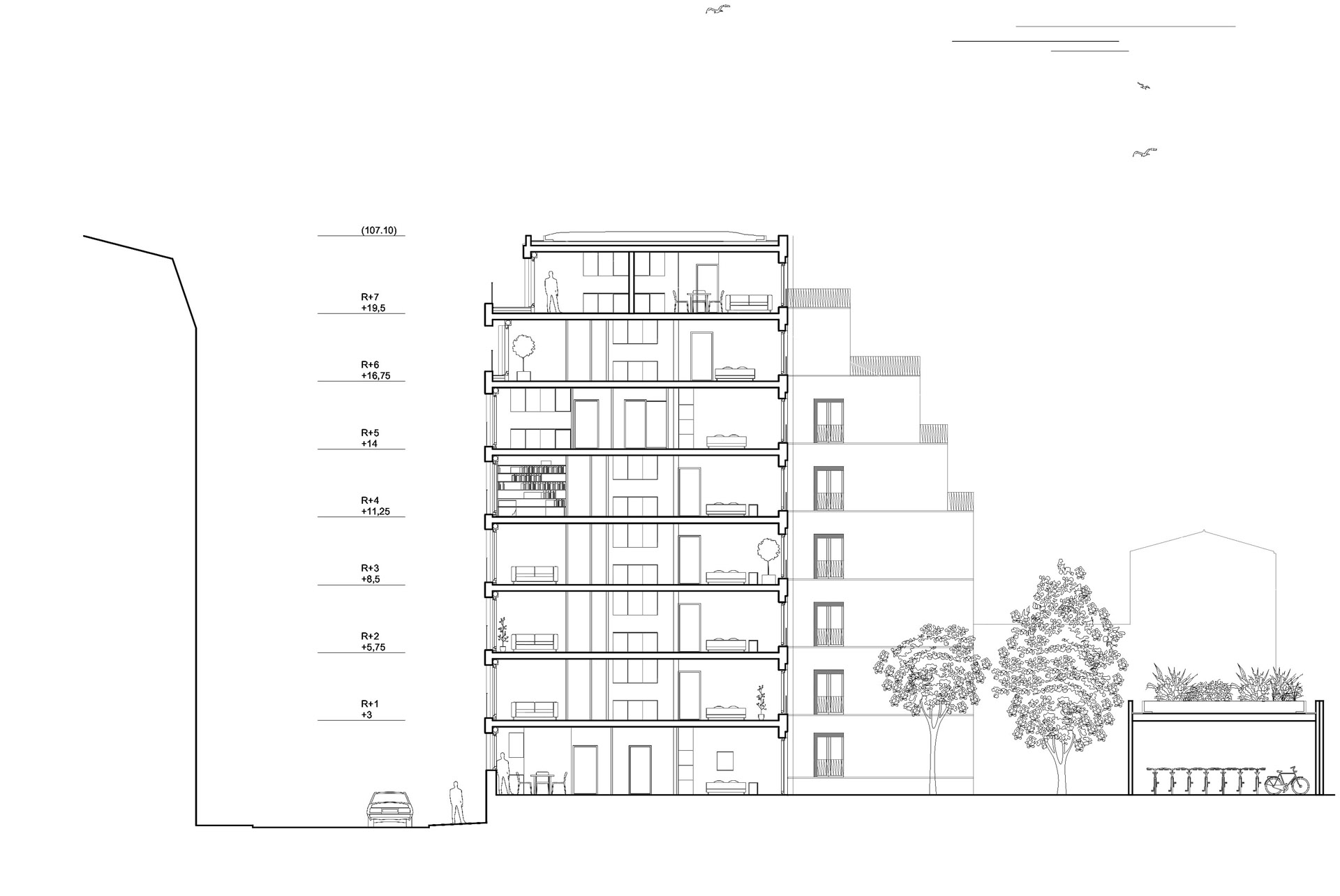

I continue to be amazed that cities, like Paris, can make small housing projects, like this one at 18 rue Pradier, work.

The site is approximately 277 m2:

And yet, social housing developer Seqens built 8 floors, 15 apartments, and even used a stone facade with built-in sun shades on the windows.

The total building area is approximately 1,030 m2 (~11,086 ft2). That's an average of 1,385 ft2 per floor, which would be unthinkable here in Toronto with our two required means of egress.

So let's consider some of the math.

My internet sleuthing tells me that this site last sold on December 6, 2018 for €3,950,000. That works out to ~€263k per door or €356 per buildable square foot. This is a wild land basis!

So is it that construction costs are that much lower or that the project received heavy subsidies? Maybe it's both. I shall continue sleuthing.

Project photography by Cyrille Lallement via ArchDaily; building section from Mobile Architectural Office

Zurich opens new bicycle tunnel

Tunnels can be used for all sorts of fun purposes. You could, for example, build one under a major urban highway in an attempt to relieve traffic congestion.

Alternatively, you could build a tunnel for bicycles; one that stitches together two disconnected parts of a city and creates a new modern parking facility for 1,240 bicycles. And on May 22, Zurich unveiled exactly this.

Here's a video (I have no idea what the guy is saying but hopefully it's positive).

The new tunnel — called the Stadttunnell — is only 440 meters long. But it runs under Zurich's main train station and connects District 4 and 5. Previously, this was a more awkward and dangerous connection given the train station.

What's also interesting about this tunnel is that it was started in the 1980s as part of a planned urban highway. But when that was scrapped, the tunnel sat dormant. Now it's back and it shows a massive commitment to sustainable mobility. The project cost 38.6 million Swiss francs.

I'd love to check in a year from now to see how well used it is, and how many people park their bikes here. Thankfully, there's a bike counter.

Cover photo from Stadt Zürich

You just need to get into the market

I have vivid memories of being in a broker meeting many years ago talking about development land in Vancouver. Our team's comment was that it felt expensive. I mean, Toronto was expensive, and Vancouver was even more. Why? It has one-third the GDP of Toronto. The response we got was something like this: "Yeah, Vancouver may seem pricy, but you just need to get into the market. Then in 5 years you'll be happy you did."

Well it's been more than 5 years and now this is the market:

The market for development sites is being tested by a roughly 50-per-cent drop in value since 2022, according to Mark Goodman. The principal of Goodman Commercial Inc. said Broadway Plan sites, for example, were selling for about $200 per square foot buildable three years ago. Sellers can now expect closer to $100 per square foot buildable, he told BIV. Goodman currently has three Broadway Plan listings.

Of course, Toronto is in a similar situation today. If there's no market for new condominiums and apartment rents aren't growing, then high-density land values are going to feel the impact. But I do think it's interesting that, in some ways, our response was being anchored by our experience in Toronto. What we know, and have accepted, often becomes a baseline for assessing if something else feels expensive or cheap.

I sometimes see the same thing with long-time developers. They remember what they used to sell and/or rent apartments for, and have a harder time accepting today. But this is a positive thing if it compels greater deal scrutiny. Advice like "you just need to get into the market" is never sound. But if you were to take this approach, I would bet that today is a better time than 5 years ago.

Don't make me search — just tell me the answer

Google is well aware that traditional search is going to die (or at least go away for the vast majority of use cases). I don't want to search for things if I can just be told the answer.

Here's an example. I was installing new light fixtures in our bedrooms this week and I wanted a refresher on wire colors.

Historically, I would have done a Google Search, which would have then led me to some website or to some lengthy YouTube video that I didn't actually want to watch and that I would have had to scan through to find the salient parts.

But today that feels old school. Instead what I did was take a picture of the ceiling box and ask ChatGPT to just tell me the answers.

Voilà:

It seems almost trite at this point to talk about the virtues of AI. But over the last few months, I have found that — just like that — it has become an integral part of my everyday workflow.

This is true whether I'm playing electrician, planning travel, writing a blog post (and I want an assistant to find me data), or I'm looking to brainstorm around something business related.

I'm sure the same is true for many of you as well.

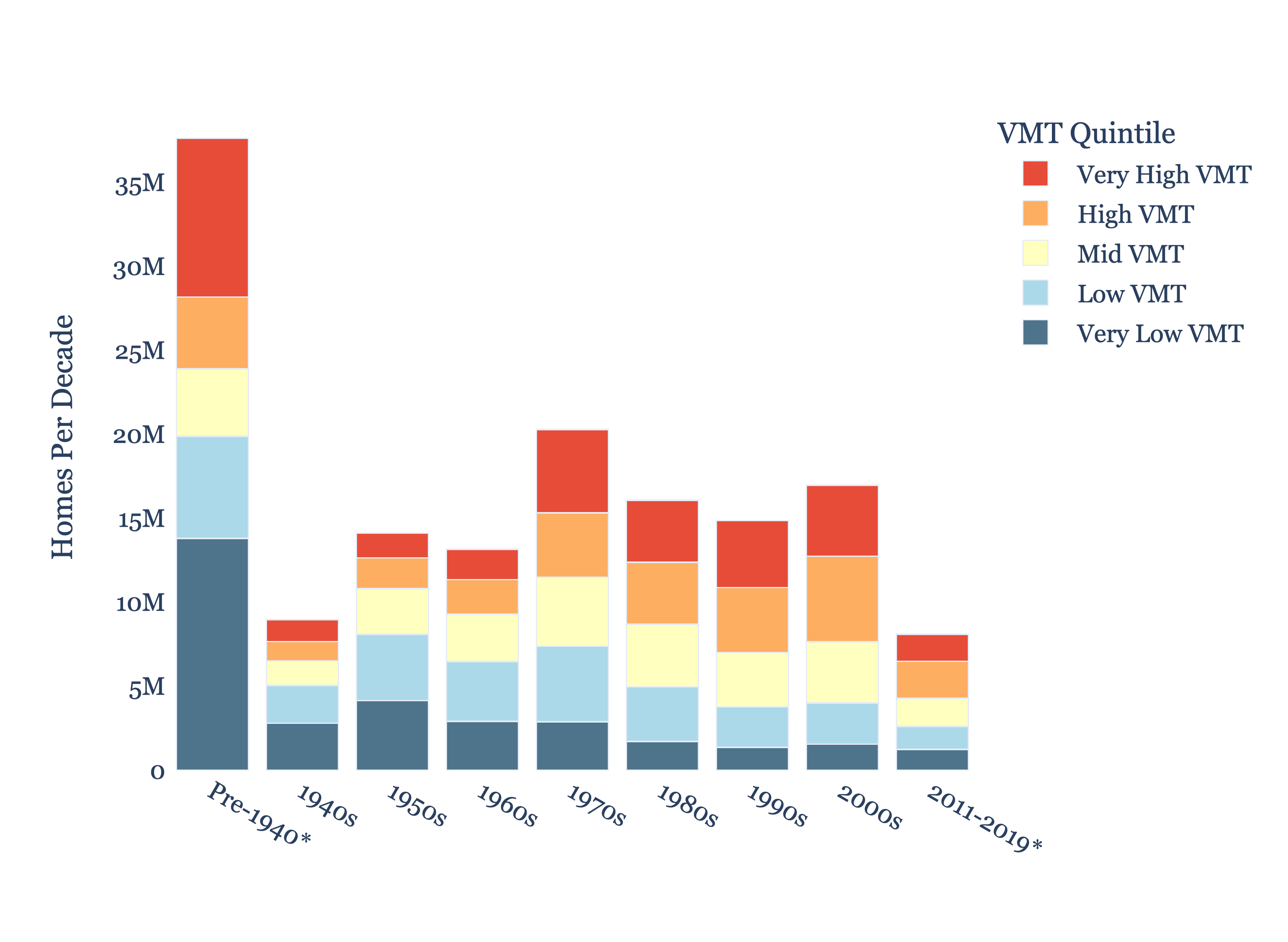

How far do you drive each day?

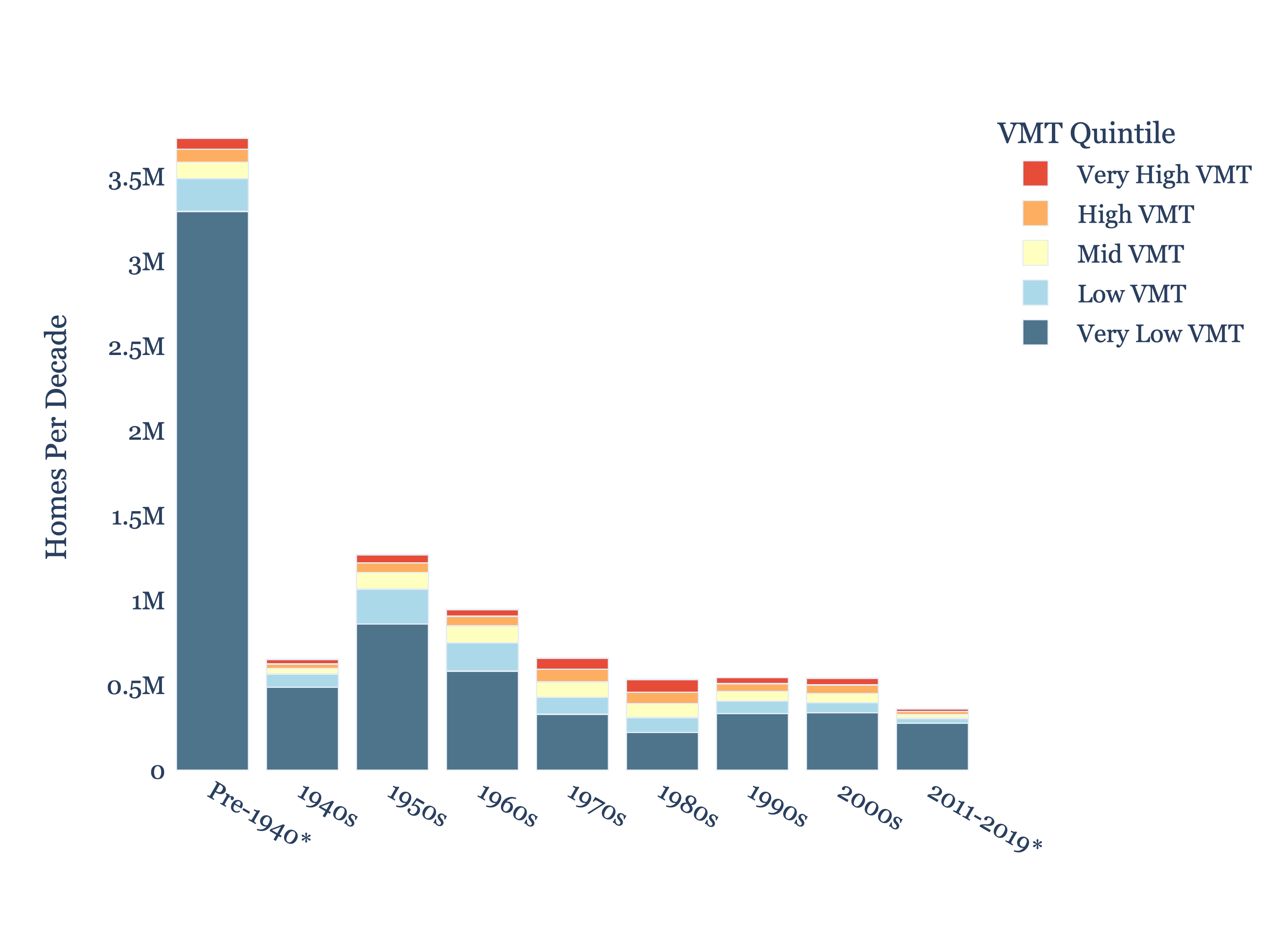

Sprawl is how much of the US provides new housing, and so it's interesting to ask the opposite question: Which cities are actually building new housing in walkable neighborhoods? Here is a study published this week by the Terner Center for Housing Innovation at UC Berkeley that looked at exactly this. What they did was divide all US neighborhoods into five categories based on vehicle miles traveled (VMT) per resident in 2023.

The categories:

Very Low VMT - 12 miles per person per day

Low VMT - 17.3 miles per person per day

Mid VMT - 21 miles per person per day

High VMT - 25.5 miles per person per day

Very High VMT - 37.5 miles per person day

These seem like oddly specific distances, but it's what they used to sort new housing supply. Here's all of the US:

Since the 1950s, new home production in very low VMT neighborhoods has generally been declining. Most of the lower VMT stuff was built before the 1940s, which is why New York City is so walkable and its chart looks like this:

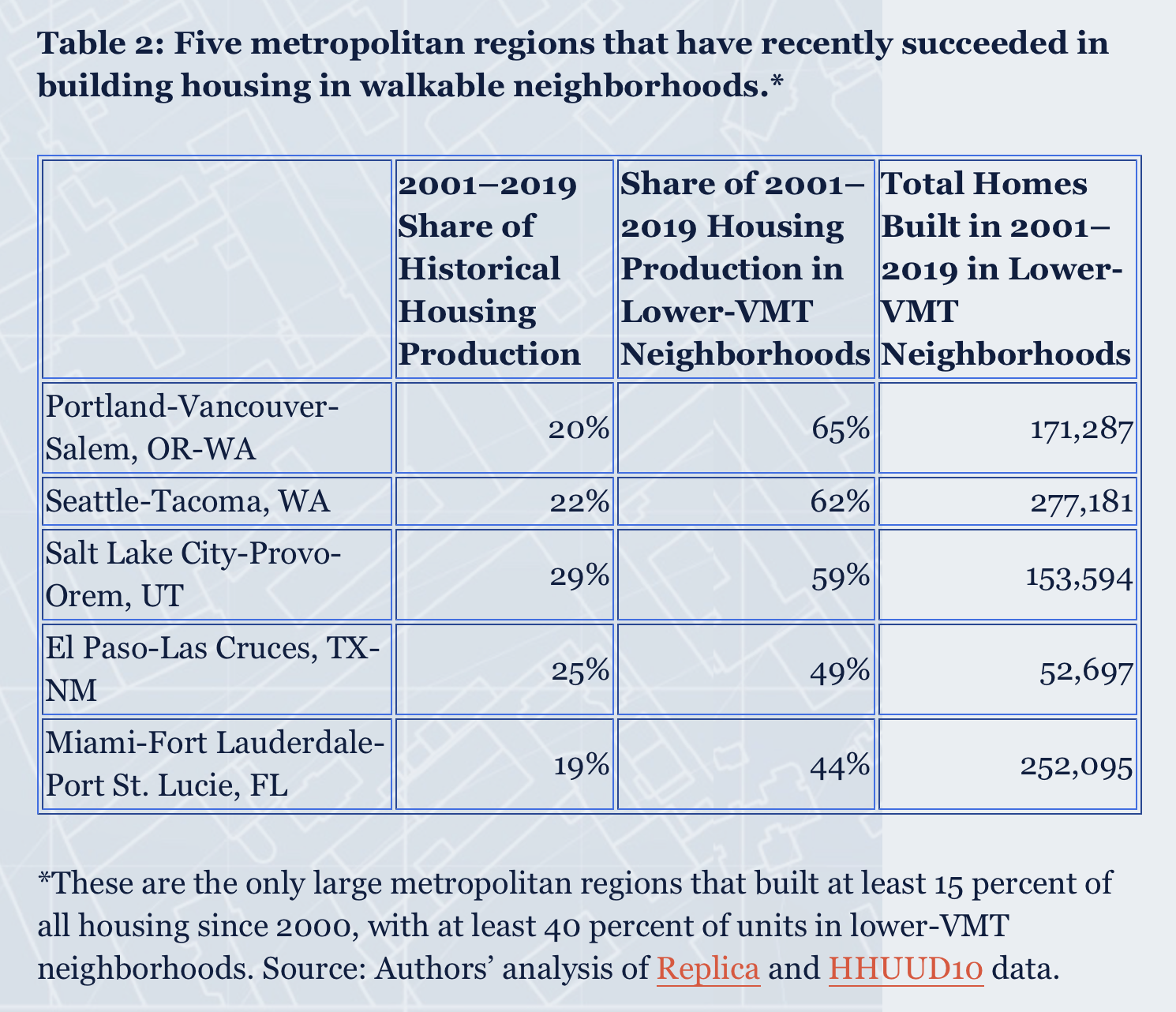

Most newer cities do not build in this way. In fact, based on this study, there are only five large metro areas in the US that have (1) built at least 15% of their total housing since 2000 (meaning, they're a younger city) and (2) built at least 40% of their homes over the last decade in lower-VMT neighborhoods (very low and low).

These metro regions are:

This is not that many cities. At the same time, is it even the right benchmark to be aspiring to? "Lower VMT" just means you don't need to drive as much as you might in other neighborhoods. But it doesn't necessarily mean that you live in an amenity-rich and walkable community. What about the new homes being built in neighborhoods where people don't need a car at all? How many of these exist?

Very few, I'm sure.

Cover photo by Jo Heubeck & Domi Pfenninger on Unsplash

Canada has $2.42 trillion of residential real estate debt

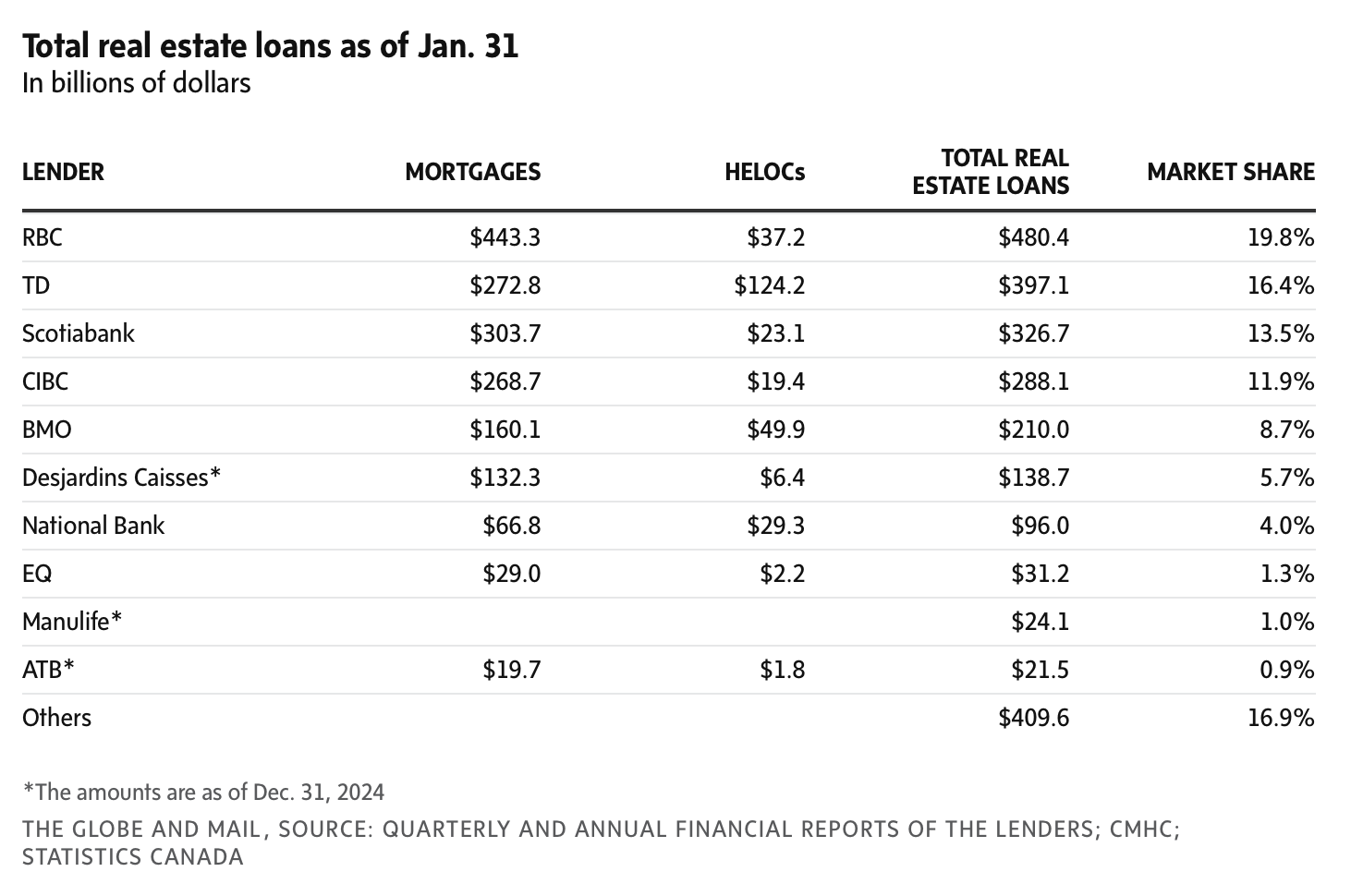

Here's an interesting table via the Globe and Mail:

As of January of this year, residential real estate loans in Canada totalled approximately $2.07 trillion. On top of this there's another $350 billion in home equity lines of credit. This brings total loans secured by residential real estate in this country to about $2.42 trillion.

What this chart really shows, though, is how concentrated the mortgage market is. The "big six" banks make up about 74% of the market. If you include Desjardins, the total increases to 80%. That's pretty much the market.

Cover photo by Tiago Rodrigues on Unsplash

I want to be a digital nomad

In my opinion, digital nomadism is a growing trend for at least two reasons: 1) people like traveling (it's more fun than sitting in an office cubicle) and 2) technology keeps making it easier to work in a decentralized way.

This is not a new phenomenon, but it's a growing one. In 2020, it was estimated that there were ~11 million so-called digital nomads in the world. This year it's somewhere around 40 million people. And it's hard to imagine this trend reversing.

Let's consider what's happening on the technology side. This week at Google I/O, the company announced a lot of AI-powered tech in the hopes of not becoming extinct as a result of it. And one of these things was a new 3D video communication platform called Google Beam.

Two things are really neat about this tool. One, it uses some AI volumetric video model to make the person in front of you appear in full 3D. So it's closer to real life. And two, it does real-time language translations. Here's a video of it in action:

In watching this, my mind immediately went to "this is going to make it even easier for people to work from Bogotá." It also collapses the world. Now we can all speak to each other regardless of language.

Imagine, for example, being able to participate in a community meeting for a new development project in Bogotá. You could be at home speaking in English and the community could be yelling at you in Spanish. That's powerful.

There's also speculation that Apple will be adding real-time translations to its AirPods later this year. Meaning, you won't need to hide behind layers of screens and technologies. You'll be able to get yelled at in person!

All of these innovations are only going to make it easier for people to live and work fluidly around the world. And I strongly believe that an increasing number of people will take advantage of it. But now the hard part: What does this mean for cities, real estate, and everything else?

Cover photo by Random Institute on Unsplash

Visual preference survey

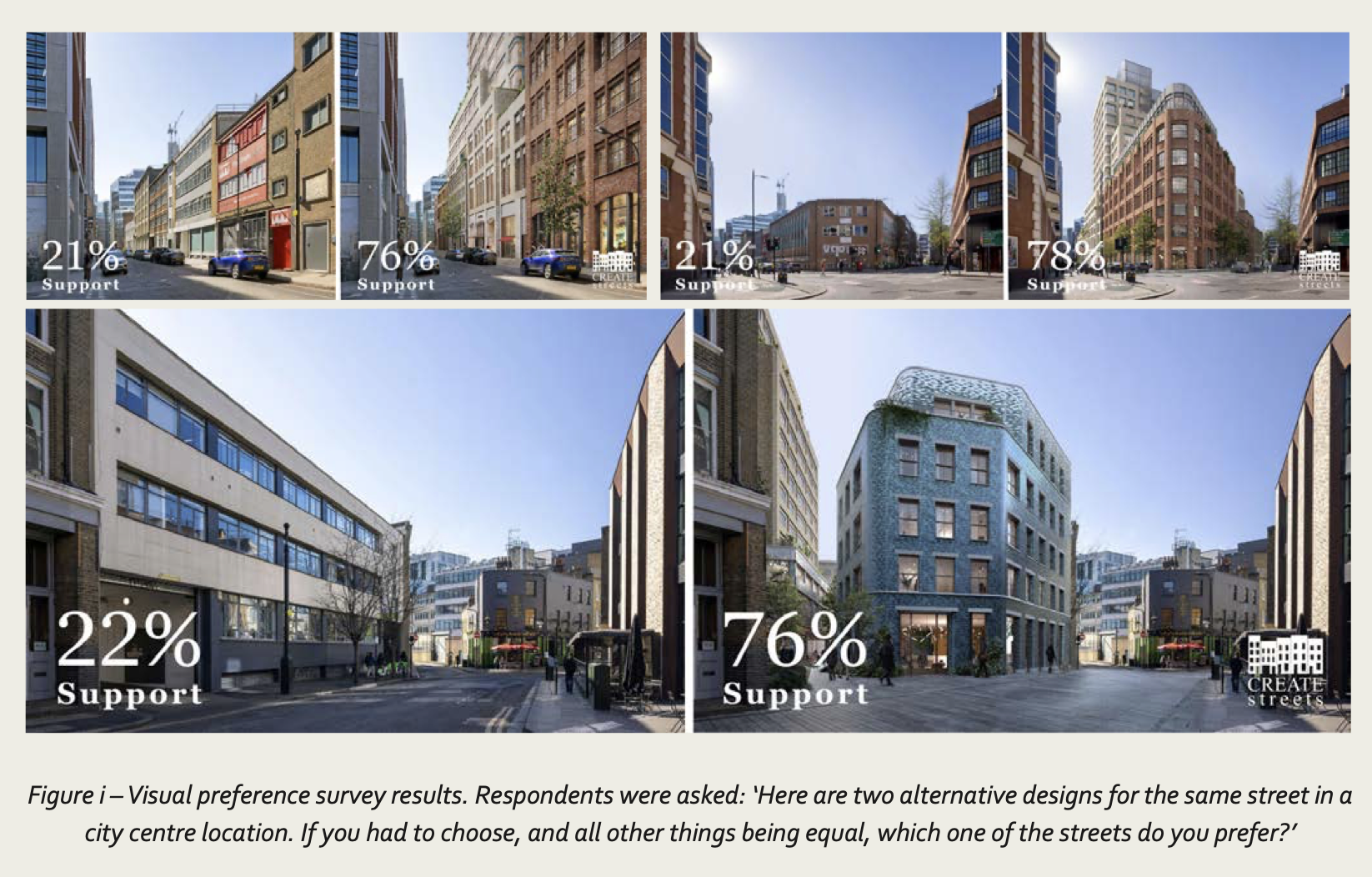

Create Streets recently published this review of the proposed Shoreditch Works development project in Hackney, London. And one of the interesting things they did as part of it was something they call a visual preference survey. What this means is that they showed a statistically representative sampling of over two thousand British people some before and after images so they could choose which they prefer.

Here's how they responded:

As you can see, from a visual perspective, there was/is strong support for the proposed development. At least according to these three views. This is despite the fact that the proposal is, of course, taller than what's there today. What I think this starts to show is that good design matters. People respond positively to beauty. And, that it's important to show what will happen at street level above all. This is how we all experience cities.

Visual preference surveys aren't all that common. I'm not sure I've seen one conducted for a new development. But it's a great idea and I plan to borrow it from Create Streets.

Cover photo from Shoreditch Works

21

21